Become a Confident & Knowledgeable Investor as an Expat

1,500 +

PARTICIPANTSSTUDENTS

15 hours

OF TRAININGOF TRAINING OVER 7 WEEKS

If you have an international situation, a high income, and significant savings or assets, you might be wondering how to make your money work better for retirement...

Investing and retirement planning can feel complicated for expats in Switzerland and Swiss citizens with finances and retirement benefits spread across multiple countries and currencies. This is even more true for Americans living in Switzerland or those working for international organizations.

High fees, complex tax rules, and country-specific pension systems often don’t align with a cross-border financial situation.

If you’re already investing but feeling unsure...

Maybe you started investing years ago through a bank or in ETFs on a trading platform, or you own property or stocks from a previous job—but you worry about high fees or whether your investments are well-invested and diversified enough. Managing assets in different countries and currencies can be challenging. And now that you're getting older, it makes sense to invest in a more strategic and organized way to grow your assets for retirement, whether you plan to stay in Switzerland or move away.

If you’re ready to invest but feeling hesitant...

You have a high income and good savings, but they’re just sitting in a bank, losing value due to inflation. You may feel unsure about where to start with investing or want to avoid mistakes as you plan for passive income and a secure retirement in Switzerland, in your home country or elsewhere. You may also be thinking about leaving a financial legacy for your children and want to make good decisions from the start.

Invest at REST: A 7-Week Learning & Implementation Program to Grow a Large Portfolio and Plan for Retirement

In 7 weeks, you’ll learn how to build a time-efficient portfolio with clear steps for managing tax, pensions, and currency across borders. Each lesson builds your confidence and knowledge, showing you how to invest in your situation.

Through live Q&A calls, calculators, and easy-to-follow video lessons, you’ll develop a personalized investment plan that fits your unique multi-country situation. By the end, you’ll have implemented a clear investment strategy, giving you peace of mind that your money is working toward the future you envision—whether that means optimizing your pension, investing an inheritance or divorce settlement, or growing a portfolio for a flexible retirement in Switzerland or abroad.

Key highlights of Invest at REST

01

A 7-week digital course curriculum that's very detailed, yet explained in a way that's practical

02

Get multi-country investment, tax and pension planning tips and strategies

03

Ask questions and get answers on how to apply the program material in your situation

ANTICIPATED TIME COMMITMENT: 2 HOURS PER WEEK

Maximize your time with a streamlined schedule

We know your time is valuable. That’s why Invest at REST requires just two hours per week to deliver detailed information, crucial tools and simple strategies you can implement right away.

The Curriculum

See what’s inside the Invest at REST Program

Build the Foundation for Successful Investing

Take on a new way of thinking about your finances which fits your multi-country situation. In this section, you’ll learn the principles you should follow to grow your portfolio and plan for retirement in a way that works for your unique, cross-border lifestyle.

- Understand how the stock market can help grow your wealth without spending hours analyzing the stock market or managing your portfolio.

- Learn to build a well-diversified portfolio that spreads out risk across different asset types, countries, and currencies.

- Discover how consistent, recurring investments over time can lead to significant results, even when markets go up and down.

- Get clear and confident about the exact steps needed to achieve your retirement vision given your international background.

- Learn how to uncover, manage and reduce investment fees so that more of your money goes toward growing your portfolio.

Define How Much to Invest

This part provides a crystal-clear view of your financial position, giving you useful tools and strategies to make informed, confident decisions that fit your multi-country situation.

- Get a clear picture of your net worth by listing all your assets and debts, so you know exactly where you stand financially.

- Gather essential pension details from each country where you've contributed to the retirement system, including employer pensions. This will give you a clear picture of your current retirement savings and what to anticipate in retirement.

- Calculate how much you should invest to make your retirement vision a reality with our in-house calculator tools that you can tailor to your specific situation.

- Learn how retirement systems work to maximize benefits across multiple countries and understand what you can expect once you retire.

Choose an Investment Provider

Gain confidence navigating the world of investment platforms. This module cuts through the noise, helping you compare, select, and get comfortable with the investment providers that best fit your preferences.

- Explore the unique advantages and downsides of various investment platforms in Switzerland and across Europe, incl. the UK. From do-it-yourself trading accounts to hands-free robo-advisors and everything in between, you will find the perfect fit for you.

- Access our database of preferred investment platforms to compare fee structures and features across providers, avoid hidden costs, and maximize investment performance.

- Discover how to manage and rebalance your portfolio over time, whether you prefer automated adjustments or a hands-on approach to keep your portfolio aligned with your long-term strategy.

- Learn to assess platform safety, including important factors like omnibus accounts and securities lending, so you feel secure investing with the provider of your choice.

- Follow along with step-by-step demo videos that show you how to open accounts, place trades, and use various platform features. You’ll feel confident investing by yourself in no time.

Select Your Investments

Learn how to assess all kinds of investments, including ones you already own. Discover how ETFs can make investing easier and stronger for someone with a multi-country lifestyle, so you can confidently build a solid and well-diversified portfolio.

- Explore the ETF ecosystem and key indexes to understand how they function, their advantages and disadvantages, and how to use them to build a well-diversified portfolio.

- Discover various ETF strategies, from country and industry-specific ETFs to all-in-one solutions that simplify investing and improve investment performance.

- Navigate the essential ETF terms and technical details, breaking down complex terms so you can select the right ones for your situation.

- Assess the financial and ethical aspects of sustainable investment options to help you decide if they are a good fit for your portfolio and, if so, how best to include them.

- Evaluate your current investments by reviewing their fees, costs, and overall strategy. This will help you decide whether to keep them or make adjustments for more portfolio growth.

Reduce Currency Risk & Conversion Costs

Master currency management as an investor with cross-border finances. In this module, you’ll learn how to pick the best currency for your investments, handle currency risks, and reduce conversion costs.

- Complete your currency "reading grid" to see how exchange rates affect your investments and choose the best investment currency for your needs.

- Learn how to manage currency risk and reduce the chances that exchange rate changes will impact your portfolio growth.

- Understand how currency hedging works and when it’s a good idea to use it to keep your investments safe from currency movements.

- Find easy ways to convert currencies that help you avoid high conversion fees and grow your investments faster.

Optimize for Tax

This module covers practical tax strategies for investors with finances in multiple countries. You'll be able to make better tax-saving investment choices and follow the rules, even when managing assets in different countries.

- Learn the basics of investment taxation and how tax affects your investments, so you can make better decisions.

- Discover how taxes apply to ETFs and index funds and choose options that work best in your situation.

- Use our tax planning checklist and leverage Artificial Intelligence tools to ensure you understand and cover all tax details relevant to your situation as a resident in Switzerland with cross-border finances.

- Understand how investment taxation works in Switzerland and differs across Europe and the UK, and get insights on how to optimize for tax when owning assets in more than one country.

- Compare the performance of contributing extra to your Swiss pension plan versus investing privately in your situation.

Design Your Portfolio & Implement

Build a portfolio tailored to your unique multi-country situation for the long term. This module walks you through essential strategies for combining stocks, bonds, and other assets, helping you create a strong portfolio.

- Determine the ideal proportion of stocks vs. bonds and other assets based on your age, retirement timing, and risk tolerance.

- Understand home bias inside a globally diversified portfolio and whether you need one in your portfolio given your cross-border situation.

- Learn how to adjust your portfolio as retirement approaches to ensure a smooth transition.

- Review how to make safe withdrawals from your portfolio in retirement, balancing income needs with a portfolio that lasts until the end of your life or that you can pass on to your children.

- Complete the last steps of your portfolio implementation effort tailored to your multi-country situation. Finalize your investment platform selection, open your investment account(s), fine-tune your investment selection, and place transactions.

What you'll learn

1. Build the Foundation to Grow Wealth as an Expat

You'll uncover the essential strategies for growing and managing wealth when living an international life, covering stock market principles and retirement planning across borders.

2. Get Clear on How Much You Should Invest

You'll use our calculator tools to assess where you stand financially. You'll also calculate how much you should invest to ensure you'll be able to maintain your standard of living in retirement considering your multi-country lifestyle.

3. Choose the Best Investment Platforms for Expats

You'll get access to our list of recommended investment platforms in Switzerland and across Europe & the UK, incl. those that work well for expats, sorting through the noise and navigating directly to the best options.

4. Select the Right Investments

You’ll know exactly how to evaluate and select Exchange Traded Funds (ETFs) and other investments for your portfolio, helping you avoid the stress of dealing with too many choices, with clear criteria to find the right fit for your preferred investment strategy.

5. Navigate Currency Challenges

You'll discover how to manage multiple currencies and reduce foreign exchange risks. You'll also learn how to select the most suitable currency for your portfolio and minimize currency conversion costs for more portfolio growth.

6. Optimize Your Portfolio for Tax

You’ll learn how taxes affect investments and get tips on how you could make your portfolio more tax-efficient as a Swiss resident, taking into consideration your specific situation with multiple countries involved.

7. Design Your Portfolio and Implement

You'll build a strong portfolio combining stocks, bonds, and other assets. You'll open your investment account(s) and place transactions. You’ll also learn how to make safe withdrawals in retirement to create a steady income while building generational wealth.

Q&A Calls

Join us for live Q&A calls so that we can help you customize your investment plan to your specific situation.

Live Q&A Calls

The program also includes group Q&A calls twice per month, with access granted for one full year. This is where you can get answers to your specific questions on how to apply what you learned to your situation, especially when things get complicated due to your multi-country situation or US person status.

Apply NowACCESS SPECIAL ADDITIONAL FEATURES

You’ll also be able to access these special features to help you take full control of your finances

BONUSES

Bonus #1

Tax Summaries

Download our tax summaries for Switzerland, Germany, the Netherlands, Belgium, France and the United Kingdom. Learn the local tax aspects to consider with regard to investing so that you can avoid costly mistakes that could arise in your specific situation.

Bonus #2

Example ETF Portfolios

Access our example portfolios, which include a variety of ETFs listed in CHF, EUR, USD, and GBP. These examples are designed to give you both inspiration and practical guidance on selecting ETFs for your own portfolio.

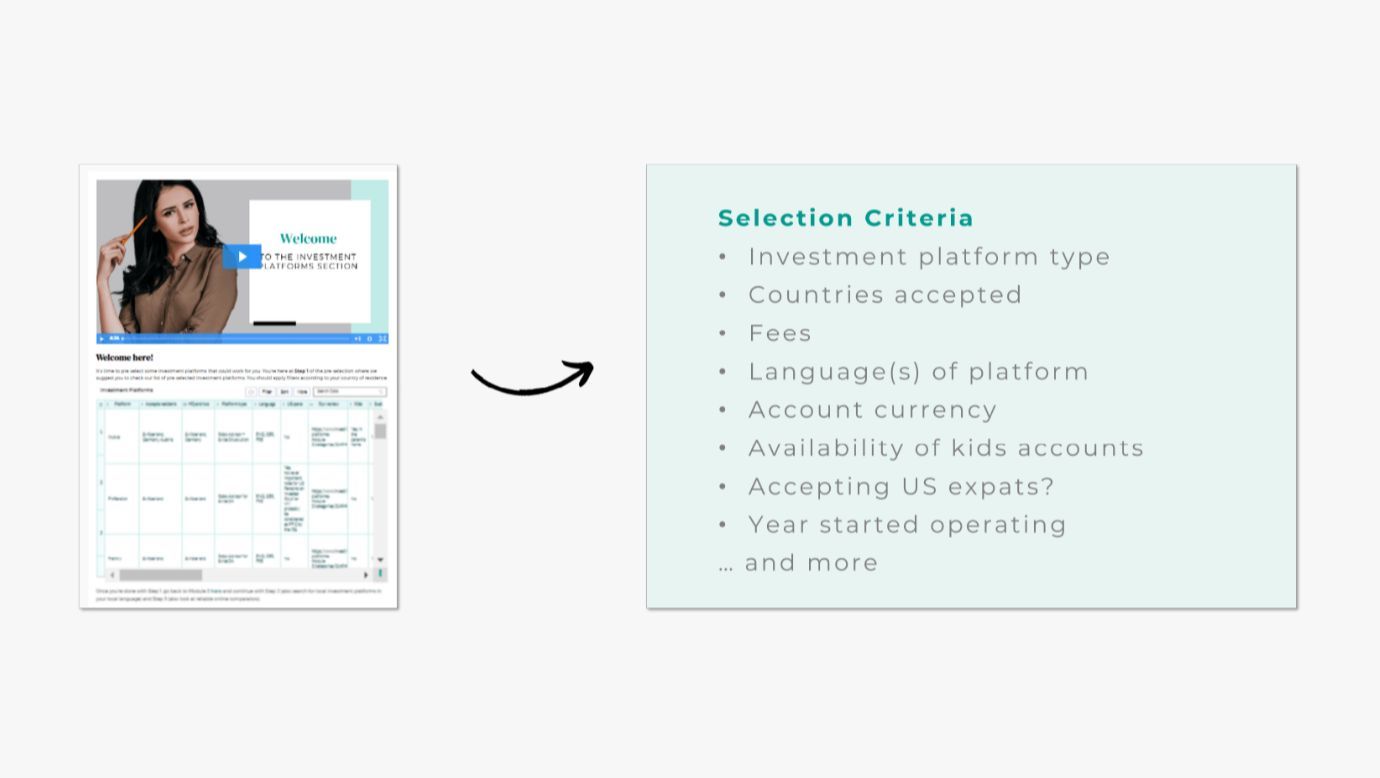

Bonus #3

Investment Providers' Database

Access our database of 40+ pre-selected investment providers & platforms based in Switzerland and across Europe & UK. You'll be able to easily search the database using criteria such as fees, languages, whether they accept US expats, if they accept kids, joint accounts, account currency available, minimum amount required, and more.

Bonus #4

Pension Playbook

Access this BONUS Module to explore helpful strategies for retirement planning as an expat or Swiss citizen with cross-border finances. Learn about pension rules and withdrawal requirements & procedures in Switzerland, Europe, and the UK, and learn how to use Artificial Intelligence tools to obtain detailed pension information for your specific constellation of countries.

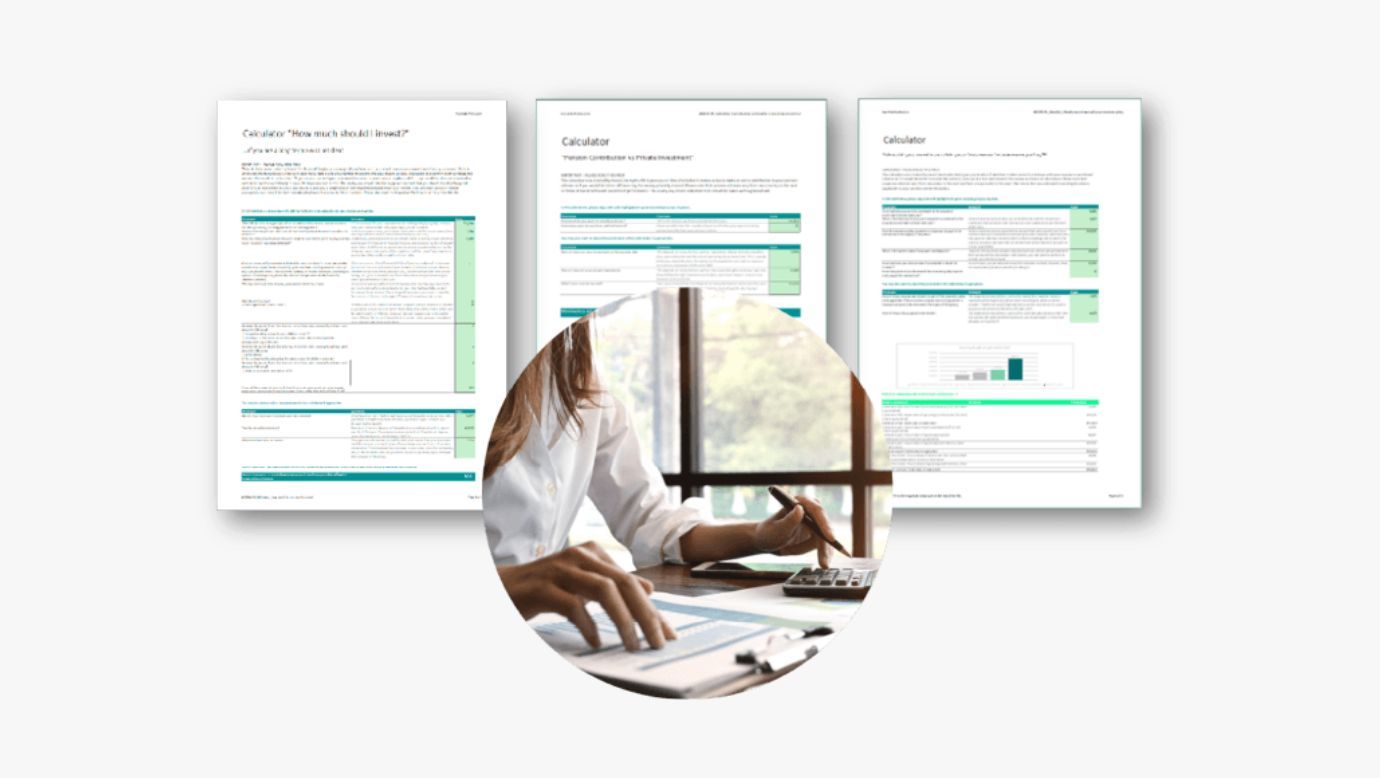

Bonus #5

Calculator Tools

Get access to calculator tools that are easy to use to make the right decisions about how much to invest and what to do with your existing investments. These tools will bring you clarity about where you stand and what exactly needs to be done to achieve your financial goals and desired retirement timeline.

Bonus #6

New Country Checklist

Prepare your move to another country with our New Country Checklist to ensure you do everything you need to optimize for tax, pension planning, and bank account management before and after your move in or out of Switzerland.

Bonus #7

Advanced Investment Strategies

Explore additional investment options like real estate, crypto, forex, venture capital, and private equity to accumulate the knowledge required to assess any kind of investment opportunities that may come your way and see if they would fit your situation and preferences.

Bonus #8

Family Strategies

Learn strategies for investing for children, teenagers and young adults, and involving your spouse or partner to turn financial growth into a collaborative and positive experience instead of a source of conflict.

ACCESS THIS SPECIAL OPTIONAL FEATURE

You’ll also be able to access this optional module if you are an American Citizen

OPTIONAL MODULE

Special Module for US Passport Holders

Learn how, where, and what you can and cannot invest in as a US citizen living in Switzerland. Discover both the limitations and the potential opportunities available to you as a US citizen living abroad to remain compliant and prevent costly filing mistakes. Note: Mandatory if you are a US citizen Additional Cost = CHF 550 CHF 450

What Students Say about the Program

"Aysha can simplify very complex things, so it's easy to understand"

Renata Pollini

Oberägeri, Canton Zug

"I have now invested all my savings and constantly put in more on a monthly basis"

Susanne R.

Zurich

“The section for American expats was invaluable!"

Lavinia Walker

Geneva

“The tools we could download were incredibly helpful in making decisions"

Anne M.

Zurich

Who teaches

Invest at REST?

Aysha

van de Paer

Founder of Invest Like Aysha

I've spent nearly 20 years in the financial industry, most of that in corporate environments at international investment firms and consultancies. I also invested several million of my own money in the stock market and also in real estate, private equity, crypto and venture capital following research-backed strategies as well as many years of trial-and-error.

Originally from the French-speaking part of Switzerland, I moved to Zurich in 2014. Before that I lived in New York, Amsterdam, Dubai, Munich and studied in the UK, which means I’m familiar with the struggles of moving and managing money in multiple bank accounts, currencies, pension and social security systems in different countries and languages. I’m bilingual in English and French and speak German and Dutch more or less fluently.

My eldest son is an American citizen as he was born in New York. And with that, I’m confronted with the realities of American citizens abroad, including restricted access to investment services and US tax filings and compliance requirements.

I’m also a single parent of two after losing my husband, Karl, in a road accident in 2017. And so I had to face and learn quickly about things like inheritance proceedings and social security benefits across borders and how living the expat life makes everything financial more complicated.

Fanny

Plattner

Co-Creator Invest at REST

I am a Certified Financial Planner and Certified Public Accountant with nearly two decades of experience in finance, audit, and controlling at Novartis, a global pharmaceutical leader, and EY, an international audit firm.

I launched my career at SUVA, a Swiss social insurance company, where I built a strong understanding of social security and retirement issues.

Before settling in Basel, I spent several years abroad, spending time in India, Australia, and Brazil.

In addition to my professional experience, I invest large sums in the stock market and I am a property investor, owning a real estate company with properties across Switzerland.

Since joining my sister Aysha in 2020 to launch the Invest at REST program, I supported over 1,500 clients on their investment learning and implementation journeys. My diverse professional background in the world of finance has given me a well-rounded perspective on all aspects of personal finance and investing.

As Seen On:

Aysha delivering a popular TEDx talk in Lausanne, Switzerland in front of an audience of 1,400+ people.

Aysha was featured on the French-speaking Swiss national television channel RTS.

What Students Say about the Program

“The program is easy to understand and to follow"

Maria-Sabrina Anastasiu

Meilen, Canton Zurich

“This has provided me with much-needed answers on how much I need to retire"

Sophia V.

Pratteln, Canton Basel

“I feel ready to talk to banks without feeling completely clueless"

Lindsay Guest

Gentilino, Ticino

"I have a clearer view of where my money goes in and out"

Virginie V.

Nyon, Canton Vaud

BONUS: Membership Included When You Join Today

Join our LIVE Implementation Series

Participate in four live implementation series with Aysha and Fanny. These 2-week sprints feature live calls and a structured implementation process to optimize your finances.

- Tax Filing Sprint - (March)

- Portfolio Review & Rebalancing Act - (May)

- Bank Accounts and Insurances: Optimization - (September)

- Crafting & Revising Your Will - (November)

Dial-in for Strategic Quarterly Calls

Join Aysha for quarterly calls to gain insights into current financial and economic events, and understand their potential impact on your portfolio and finances. During these sessions, Aysha also provides exclusive bonus content and reveals her own investment & financial strategies.

Join our Get-Together Events

Join our well-attended get-together events across Switzerland to meet Aysha and Fanny in person and exchange notes and investment tips with the other participants in the program.

Online Community Access

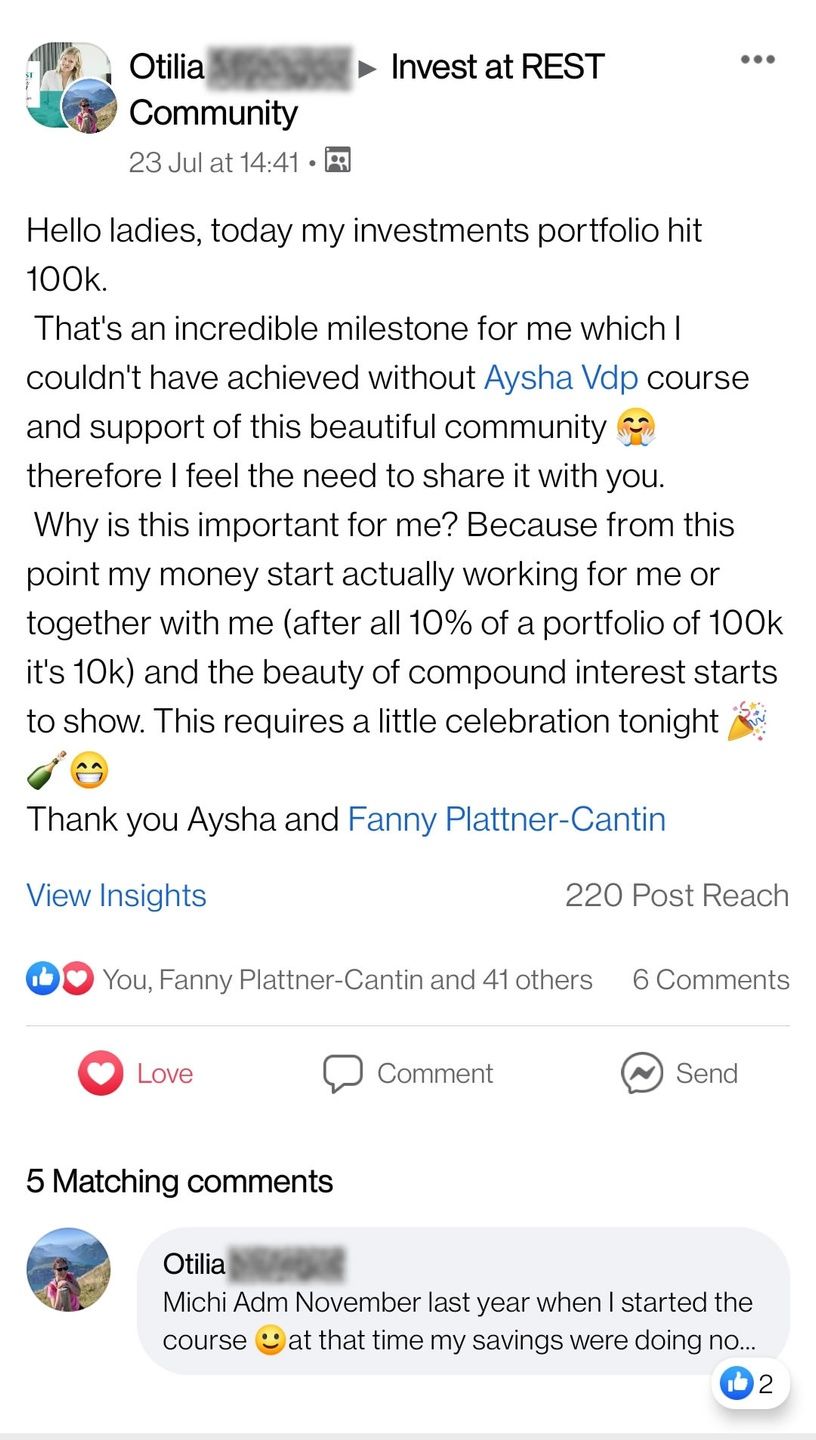

Connect with other program participants inside our online community and get a boost from interacting with people who are proactively managing their multi-country finances and growing their portfolios.

About the Membership

Be a part of a pan-European community with

700+ active members

When you enroll in Invest at REST today, you don't just access a course: you join a Swiss-based community of like-minded people who care about growing their assets, financial optimization across borders, achieving peace of mind, greater life flexibility, and early retirement.

Interact with the other program participants inside our community app: a deeply immersive online platform for finding program members near you, participating in engaging discussions, and joining in-person get-togethers.

You’ll have the chance to connect with 700+ active members on this platform. That’s 700+ opportunities to meet like-minded people who care about investing in the best way possible and get inspired by the way they handle their investments and finances.

Left: Aysha delivering a keynote speech about investing in Lausanne, Switzerland.

Top Right: Aysha teaching a workshop for a large law firm in Zurich.

Bottom Right: Aysha invited by an investment firm to deliver a presentation to their clients.

Clients & Guest

Speeches:

What Students Say about the Program

“Aysha's review about investment platforms was so helpful"

Sara F

St-Gallen

“Very clear guidance, step by step, with examples and a lot of supporting material"

Rossana I.

Lausanne

"Beautiful presentations and helpful demos!"

Olesya Meier

Lausanne

"Combination of theory and Q&A sessions made the content easily accessible for non-financial people like me"

Nathalie N.

Zurich

Join Invest at REST & become a confident investor

What's included:

- The full 7-week Invest at REST program, where you learn how to invest and implement a customized investment plan taking into consideration your multi-country tax & pension situation

- Live Q&A calls with Aysha & Fanny twice a month for one full year

- Access to all video lessons, tools and resources for one year

- Video demos on how to open accounts and place transactions

- 4x live implementation series facilitating quick tax filing, portfolio management & rebalancing, optimization of your bank accounts and insurance policies, and rapid creation or revision of your will.

- Live quarterly strategic calls with Aysha & Fanny

- Exclusive access to our Membership & Community platform for one year

- Invitations to our Get-Together events across Switzerland

- An unconditional 30-day guarantee: experience 30 days of Invest at REST, and get a full and instant refund if you’re not fully satisfied for any reason.

Apply for Invest at REST Today

Submit an Application

When you apply, we will check if you're a good fit for the program and send you all the details, including pricing options.

There is no obligation to enroll after you apply.

Try it for 30 days risk free

Remember you don’t have to say YES right now. You only have to say MAYBE. Go through the materials for 30 days risk-free from the day of purchase.

To get a refund, simply respond to the welcome email (or any other email from us) and get a full, friendly and fast refund. No phone calls, no questions asked, no hassle.

More Student Results

“I spend about 30 minutes each month managing my portfolio"

Valérie F.

Zurich

“The program is entertaining, modern, and easy to understand"

Maren V.

Zurich

"I loved the freedom to watch the sessions when I have time and space"

Raphaelle F.

Morges, Canton Vaud

“I really appreciated all the tools and the detailed list of options!"

Amalia S.

Lancy, Canton Geneva

Got questions before you enroll?

Send Aysha a message on WhatsApp message here (+41 79 509 18 99), or scan the QR code.

Apply for Invest at REST Today

Submit an Application

When you apply, we will check if you're a good fit for the program and send you all the details, including pricing options.

There is no obligation to enroll after you apply.

Try it for 30 days risk free

Remember you don’t have to say YES right now. You only have to say MAYBE. Go through the materials for 30 days risk-free from the day of purchase.

To get a refund, simply respond to the welcome email (or any other email from us) and get a full, friendly and fast refund. No phone calls, no questions asked, no hassle.

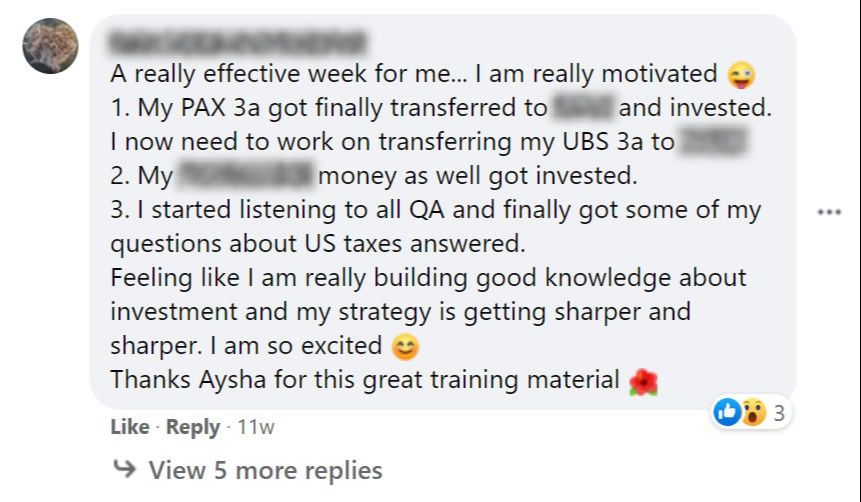

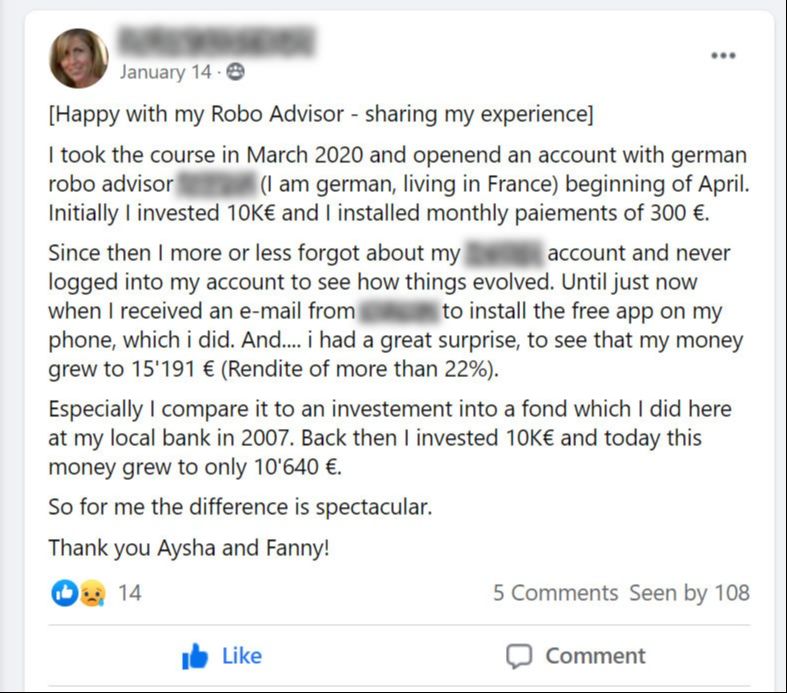

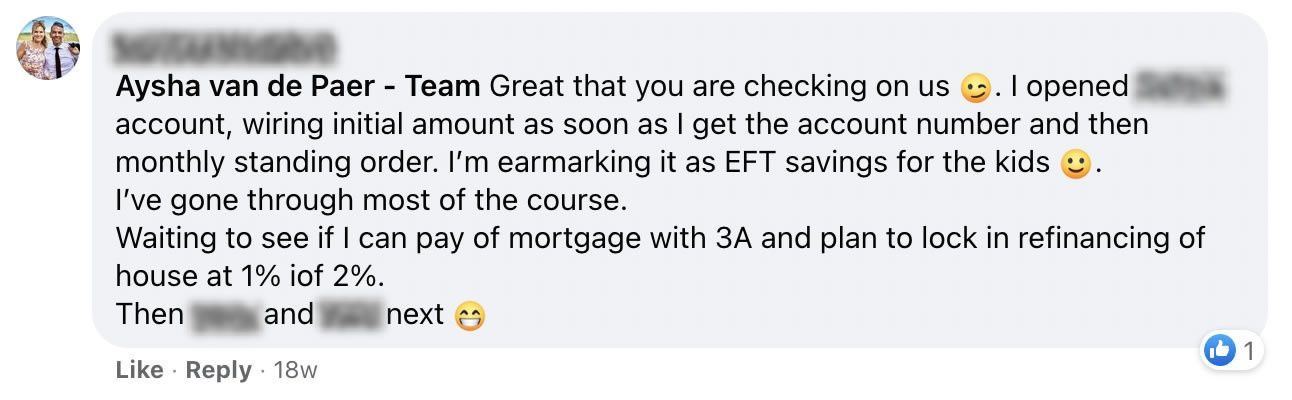

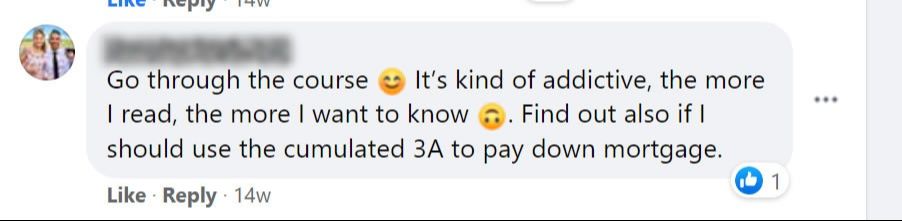

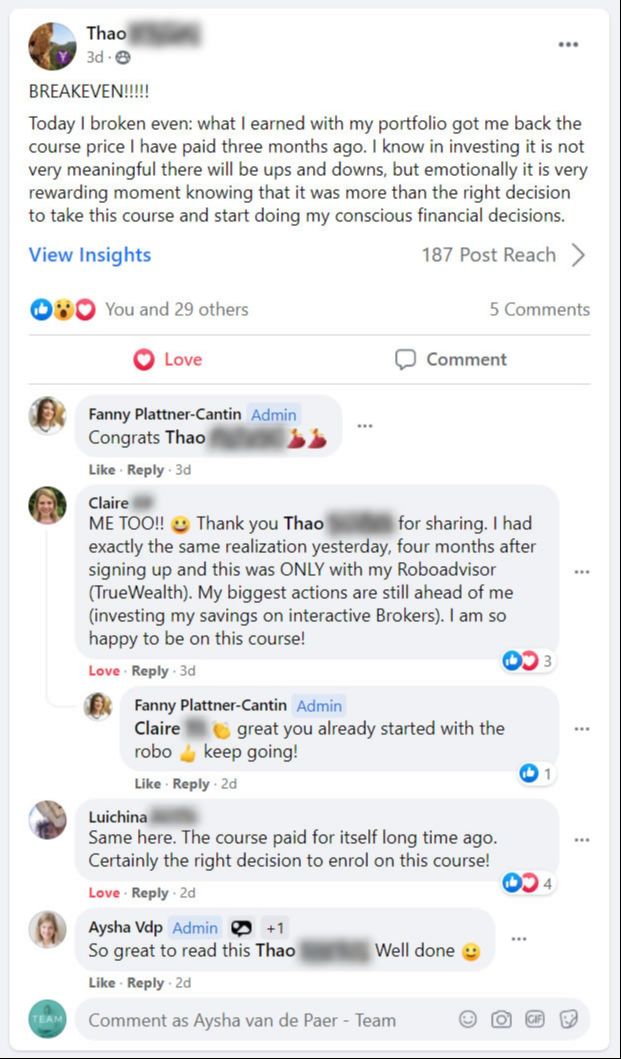

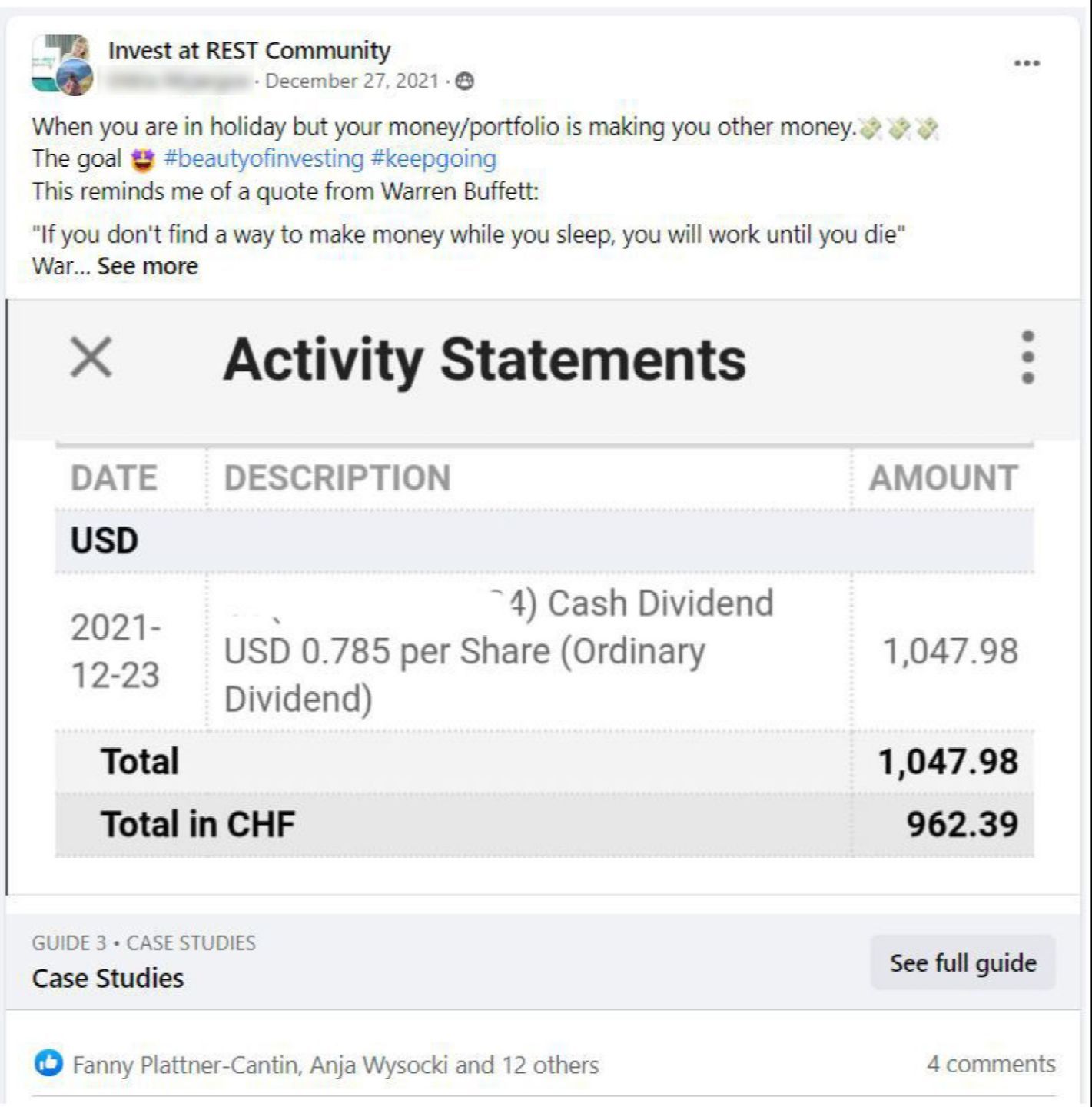

Here is some more feedback from students in the program

Below you can catch a glimpse of what the experience of current and prior students has been so far.

Apply for Invest at REST Today

Submit an Application

When you apply, we will check if you're a good fit for the program and send you all the details, including pricing options.

There is no obligation to enroll after you apply.

Try it for 30 days risk free

Remember you don’t have to say YES right now. You only have to say MAYBE. Go through the materials for 30 days risk-free from the day of purchase.

To get a refund, simply respond to the welcome email and get a full, friendly and fast refund. No phone calls, no questions asked, no hassle.

“The action items in the program checklist kept me on track"

Julia G.

Morges, Canton Vaud

“It's a one-time effort that is so satisfying and definitely worth it"

Caroline Gueissaz

Neuchâtel

"The specific examples and case studies make everything clear"

Binja F.

Lucerne

"The program is very concrete and gives easy steps to start investing"

Lea Müller

Zurich

HAVE A QUESTION?

Burning questions that prior program participants asked before signing up

When will the program start?

How long does it take to complete the program?

How long will I have access to the program?

Will I get personalized recommendations about investing?

What do I do if I need support?

Will taking this course eliminate the need to hire a financial planner?

Do you give tax advice?

Does this program cover real estate investing?

I'm an American expat, can this program help me?

I work for an international organization, can this program help me?

Are you affiliated with any financial institution?

Can I book a private consultation?

What if I already invest and only need specific parts of the program?

I'm not an expat; will the program work for me?

Can the cost of the program be deducted from taxes?

"I felt understood with my busy life and could make decisions without falling into analysis paralysis"

Cornelia Wolfenstädter

Zurich

Apply for Invest at REST Today

Submit an Application

When you apply, we will check if you're a good fit for the program and send you all the details, including pricing options.

There is no obligation to enroll after you apply.

Try it for 30 days risk free

Remember you don’t have to say YES right now. You only have to say MAYBE. Go through the materials for 30 days risk-free from the day of purchase.

To get a refund, simply respond to the welcome email and get a full, friendly and fast refund. No phone calls, no questions asked, no hassle.

© 2025, Invest Like Aysha Ltd. | Terms

The information made available on our webpages, social media accounts, events and training material of any kind and related communications is provided for educational purposes only and does not constitute investment advice, crypto-asset advice nor any kind of financial, tax or professional advice. Read the Terms for further important disclosures. Every investment involves risk, especially with regard to fluctuations in value and return. Information on past performance, where given, is not a prediction or a guide to future performance.